This means that if one day you decide to sell your house you have to pay taxes on the profit gains if you have any. The expenses that investors can add to a cost base include but are not limited to.

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Stamp duty is levied in the UK on the purchase of shares and securities the issue of bearer instruments and certain partnership transactions.

. The stamp duty is to be made by the purchaser or buyer and not the seller. 6 to 30 characters long. The calculation of the additional premium is based on the State Land Rules.

Hi A thai Magazine wants to hire me as a writer in one of their columns. The stamp duty for the sale and transfer of a property is calculated based on the purchase price. Barbados imposes a stamp duty on various instruments including written documents.

Stamp duties applicable to documents for the transfer of shares real estate and mortgages are set out below. Tax calculation The effective rate would be 107. I am from the Philippines.

However Decree 372019 in force since 14 December 2019 modified such rate for certain products and for some others. The new Lentor Central Condo will feature approximately 600 residential units in 3 towers of 25 storeys. Sample personal income tax calculation.

ASCII characters only characters found on a standard US keyboard. A League of Legends Story was released yesterday on Nintendo Switch Xbox One PlayStation 4 Steam GOG and the Epic Games Store Ruined King. The rate of tax is 020 percent of the value of the financial products.

No chargesfees provided 3 months prior written notice is given to the bank or payment of 3 months interest on the amount redeemed in lieu of notice. The tax is equivalent to the stamp tax levied at source on financial products held by Italian intermediaries. Delay in payment of stamp duty can make the individual liable to pay a fine ranging from 2 to 200 of the total payable amount.

The rates imposed vary depending on the document. The stamp duty rates effective 1st July 2019 is as below. In addition to income taxes a stamp tax is also charged on financial products held broad by individual tax resident in Italy.

E signatures - Applicability Requirements and Stamp Duty Payable. According to the announcement only Malaysians will be exempted from paying the 5 or higher RPGT for the disposal of a residential property only from 1 June 2020 and 31 December 2021. A valuation of the land is required because the law requires an additional premium to be paid when an application for a change in category of land use express condition is approved.

SS Commotrade Private Limited Vs ITO Calcutta High court - SS Commotrade Private Limited Vs ITO Calcutta High court By this writ petition petitioner has challenged the impugned order dated 30th July 2022 under Section 148Ad of the Income Tax Act 1961 relating to assessment year 2014-15 and all subsequent proceedings based on the impugned notice dat. The marginal rate would be 15. The Decree also modified the limit in Argentine pesos of export duties to be paid.

This product is non-returnable and non-refundable Players take control of a party made Katie Prices finances have. September 23 2019 at 149 pm. A capital gains tax CGT is a tax on the profit realized on the sale of a non-inventory assetThe most common capital gains are realized from the sale of stocks bonds precious metals real estate and property.

1 per annum on the arrears of outstanding for each loan daily rest basis Early Settlement. Annex 1A Statistical tables to Part 1 Annex 1B Methodological notes for the food security and nutrition indicators Annex 2 Methodologies Part 1 Annex 3 Description data and methodology of Section 21 Annex 4 National food-based dietary guidelines FBDG s used to compute the cost of a healthy diet Annex 5 Additional tables and figures to Section 21 Annex 6 Definition of country. Follow Loanstreet on Facebook Instagram for the latest updates.

A League of Legends Story Catrina 2550 VP Countries. Title Costs such as the legal fees incurred when. It is a good idea for foreigner to come to work in Thailand.

The basis and rates of premium differ between the respective states in Malaysia. These include the reintroduction of the Home Ownership Campaign 2021 HOC which features stamp duty exemptions as well as special RPGT 2021 exemptions. Ownership Costs such as those incurred when searching and inspecting for properties.

In addition if a loan was taken out to finance the purchase of the property the stamp duty payable would be a flat rate of 05 of the total loan amount. Calculation of Stamp Duty on SPA Memorandum of Transfer and Instrument on Loan Agreement. Thus the export duty rate and the ARS limit if applicable vary depending on the type of product being exported.

For the first RM100000 is 1 RM1000001 to RM500000 is 2 RM500001 to RM1000000 is 3 RM1000001 onwards is. Not all countries impose a capital gains tax and most have different rates of taxation for individuals versus corporations. The stamp duty rates before 30th June 2019 is as below.

The development will have a commercial component on ground floor where there will be more than 96000 square feet of retail commercial and FB stores. Must contain at least 4 different symbols. A 2019 study looking at the impact of tax cuts for different income groups.

For the first RM100000 is 1 RM1000001 to RM500000 is 2 RM500001 to RM2500000 is 3 RM2500001 onward is 4. Real Property Gains Tax RPGT is a form of Capital Gains Tax that homeowners and businesses have to pay when disposing of their property in Malaysia. Sep 23 2019 at 149 pm.

05 of loan amount funded for every approved loan. One of ASEAN countries. On 20 September 2019 the Government of India has introduced the Taxation Laws Amendment Ordinance 2019 the Ordinance whi.

The rate was increased to 375 effective 1 April 2019. September 18 2019 at 725 pm. Generally it is easy to calculate stamp duty according to the rates provided by the Indian Stamp Act or the State.

Lentor Modern is a brand new mixed-use development tucked in the new Lentor enclave of District 20. Incidental Costs such as your rental advertisement fees legal fees and stamp duty. There is no de minimus value.

Expenses That Can be Added to the Cost Base. In our country e-signatures are valid for around 20 years now and they have attained this status from the Information Technology Act 2000 t.

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Property Law In Malaysia Stamp Duty For Transfer Of Property Chia Lee Associates

Rental Agreement Stamp Duty Malaysia Speedhome

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Bracing For Competition Cheaper Challengers Enter Invisalign S 1 5 Billion Market

15 Top Paying It Certifications In 2019

Download Best Legal App For Malaysian Lawyers Easily Calculate Legal Fees Stamp Duty Rpgt Easy Law

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Market Share Is Shifting In The Chicken Sandwich Category After Popeyes 2019 20 Dominance

Pdf Using Probability Impact Matrix Pim In Analyzing Risk Factors Affecting The Success Of Oil And Gas Construction Projects In Yemen

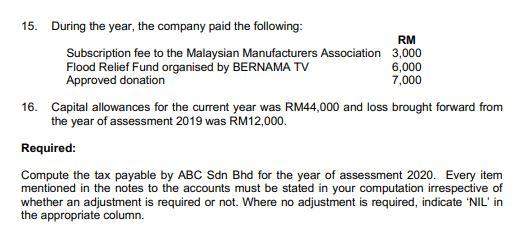

Tutorial 1 Company Taxation Question Abc Sdn Bhd Chegg Com

Property Law In Malaysia Stamp Duty For Transfer Of Property Chia Lee Associates

Legal Fees And Stamp Duty Calculator Malaysia Madalynngwf

How To Transfer Property Ownership Between Family Members In Malaysia Propsocial

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Malaysia Sst Sales And Service Tax A Complete Guide

Rental Agreement Stamp Duty Malaysia Speedhome

How To Transfer Property Ownership Between Family Members In Malaysia Propsocial